If you’re a taxpayer in India, there’s one document you simply cannot afford to ignore—Form 26AS. As we move into the 2025 tax season, understanding this form is more important than ever. Whether you’re filing your income tax return (ITR) for the first time or you’re a seasoned filer, reviewing your Form 26AS can save you from notices, penalties, or even excess taxes.

In this article, we’ll explain what Form 26AS is, why it matters in 2025, how to access it online, and how it helps ensure your tax filings are accurate and safe from scrutiny.

What is Form 26AS?

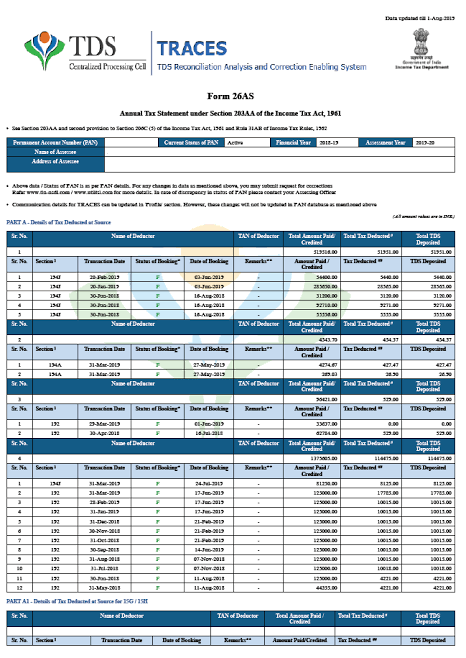

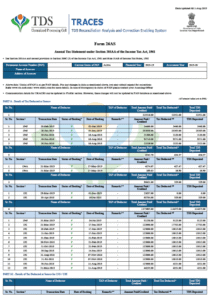

Form 26AS is an annual consolidated tax statement issued by the Income Tax Department of India. It includes details of:

- TDS (Tax Deducted at Source)

- TCS (Tax Collected at Source)

- Advance Tax / Self-Assessment Tax paid by the taxpayer

- Refunds received

- High-value transactions like property purchases, mutual funds, credit card spends, etc.

Think of it as your tax passbook, showing all the taxes paid on your behalf and matched to your PAN.

Why Form 26AS Matters in 2025

With stricter tax surveillance and AI-powered matching systems now in place, mismatches between ITR and Form 26AS can immediately trigger scrutiny or notices. In 2025, the Income Tax Department has tightened integration with banks, employers, and mutual fund houses—making Form 26AS a key piece of compliance.

Key reasons to check it:

- ✅ Ensure all TDS is credited correctly

- ✅ Avoid under-reporting income

- ✅ Prevent duplicate or missed tax filings

- ✅ Match high-value transactions

- ✅ Spot incorrect PAN or wrong entries

Even a small mismatch may delay your refund or attract a tax notice.

What’s New in Form 26AS for 2025?

The traditional Form 26AS has now been extended under the Annual Information Statement (AIS) and Taxpayer Information Summary (TIS).

New additions in 2025:

- Property purchase or sale data

- Mutual fund and share redemptions

- Rent received (for landlords)

- Foreign remittance under LRS

- GST turnover details for businesses

So in 2025, Form 26AS + AIS = Full 360° View of Your Financial Activity.

How to Download Form 26AS in 2025

You can access your Form 26AS online through the Income Tax e-filing portal:

✅

Steps to Download Form 26AS:

- Visit https://www.incometax.gov.in

- Login with your PAN and password

- Go to ‘e-file’ > Income Tax Returns > View Form 26AS

- You’ll be redirected to the TRACES website

- Select the Assessment Year (e.g., AY 2025-26)

- Choose the format – HTML, PDF or Text

- Click “View/Download”

Pro Tip: Match this with your AIS (Annual Information Statement) under ‘Services > AIS’.

What to Check in Form 26AS Before Filing ITR

Make sure you review:

- 🧾 TDS by employer – does it match your Form 16?

- 💳 TDS on bank interest – often missed!

- 🏠 TDS on rent received (for landlords)

- 💼 TDS on professional income (freelancers, consultants)

- 💸 Advance Tax / Self Assessment Tax paid manually

- 💰 Refunds – check status and date of credit

- 📈 High-value investments/purchases reported

Form 26AS vs AIS: What’s the Difference?

| Feature | Form 26AS | AIS (Annual Info Statement) |

| Issued By | Income Tax Department | Income Tax Department |

| Shows TDS | ✅ Yes | ✅ Yes |

| High-value transactions | ❌ No | ✅ Yes |

| Credit card spends, investments | ❌ No | ✅ Yes |

| Foreign remittance | ❌ No | ✅ Yes |

| Use for ITR filing | ✅ Yes | ✅ Yes (Cross-check only) |

➡️ Form 26AS is legally valid for filing. AIS is a broader info sheet to help cross-verify data.

Who Should Check Form 26AS?

✅ Salaried Individuals

To ensure your employer has deposited TDS correctly and avoid under-reporting salary income.

✅ Freelancers / Self-employed

To verify TDS deducted by clients and reconcile it with your income.

✅ Landlords

To see if tenants or companies have deducted TDS on rent payments.

✅ Senior Citizens

To track TDS on FD interest and ensure refund processing is smooth.

✅ Businesses

To verify advance tax payments, GST turnover entries (in AIS), and more.

Mistakes to Avoid

- ❌ Assuming TDS is always deposited correctly by deductor

- ❌ Filing ITR without verifying Form 26AS

- ❌ Ignoring small TDS entries (they add up!)

- ❌ Relying only on Form 16 (especially if you changed jobs)

- ❌ Skipping verification of self-assessment tax

Even a ₹100 mismatch can flag your return for review.

What If There’s a Mistake in Form 26AS?

If you spot incorrect or missing entries in Form 26AS:

- Contact the deductor (employer, bank, tenant, etc.)

- Ask them to revise their TDS return

- Wait for the correction to reflect (usually 7–10 days)

- Then file your ITR

You cannot correct Form 26AS yourself—only the entity that submitted wrong data can revise it.

Conclusion

Form 26AS is not just a tax form—it’s your entire financial footprint in the eyes of the government.

As tax rules get smarter in 2025, checking Form 26AS before filing your return is not optional—it’s essential.

Review it carefully, cross-check with AIS, and ensure your ITR reflects the exact details. A little effort now can save you from big problems later—including refund delays, notices, or penalties.